Before sharing my 2024 letter in English, I‘d like to also translate the 2022 and 2023 ones so that you have the full context. That is why I’m uploading it today even though the title says 2022.

The year ends, and I would consider it the most challenging of the last decade, one that will undoubtedly be remembered in the markets for a long time, alongside 2000 and 2008. During this year, my benchmark, the Russell 2000 Small-Cap index, had a performance of -22%, so we can already get an idea of what investing was like this year.

Basically, unless you started investing before 2009, this is probably the first REAL bear market you’ve experienced, and obviously, I am one of those beginners who learned many lessons and reflections during this difficult year. Let’s go over some of them:

“If it drops more, I buy more.”

This is a phrase I heard a lot before, especially in 2020. And I don’t blame them, it’s a phrase that makes a lot of sense (as long as you’re not in a bear market that lasts over 12 months).

I believe that the famous "Buy the Dip" strategy only works if you’re in a golden decade like 2010-2020 or if you have infinite liquidity. In my case, I was in neither of those situations, which led me to run out of liquidity several times while the market kept going down.

This will undoubtedly be a turning point in how I manage liquidity during bear markets, as I now have much more respect for them than I did during 2020 and 2021 when I thought: "Well, if we enter a bear market, the worst that could happen is that I’ll have to DCA into my positions," without considering that in real bear markets, you’ll often see your stocks at -30% or -35%, and the only thing left to do is sit and wait because you’ve run out of liquidity.

I wouldn’t wish that on anyone, but well, these are lessons I had to learn at some point.

Preferences are weaknesses

As a chess enthusiast, Magnus Carlsen is one of the people I admire most, and there’s a quote from him that I try to apply to every aspect of my life, including investing:

"I do what I believe circumstances require of me. I have no preferences; to have preferences would be to have weaknesses."

During this bear market, I took advantage of market rallies to "lock in" double-digit gains on some of the more volatile stocks that I considered expensive. Sometimes I bought them back when they dropped to the prices where I initially bought them, and in other cases, I passed on them and looked for other buying opportunities. This is far from my preference, as I prefer to invest in companies for the long term without constantly selling, but I considered it a valid alternative in a market full of uncertainty, where it was clear that the declines were far from over.

Straying from my original plan helped me generate returns that partially offset the losses of the year, but more importantly, it allowed me to keep generating cash to increase positions in my portfolio that were falling without any fundamental changes, and that I considered to be quality companies. I never stayed 100% in cash, far from it, but I did use some stocks that had sharp drops over a few days to make short-term trades.

For example:

I sold Medpace with a 39% return after it reported strong results for Q3.

I bought and sold Qualys twice this year, both times with gains above 15%.

I bought Olaplex and EPAM when they fell 50% in a single day. I held them for a few weeks and then sold with a little over 30% in return.

I think it’s important to have a foundational investment philosophy to follow, but if opportunities arise outside of that philosophy, I believe it’s good to have the flexibility to adapt to the new environment, even if it’s only partially, as in my case.

Historic Moment

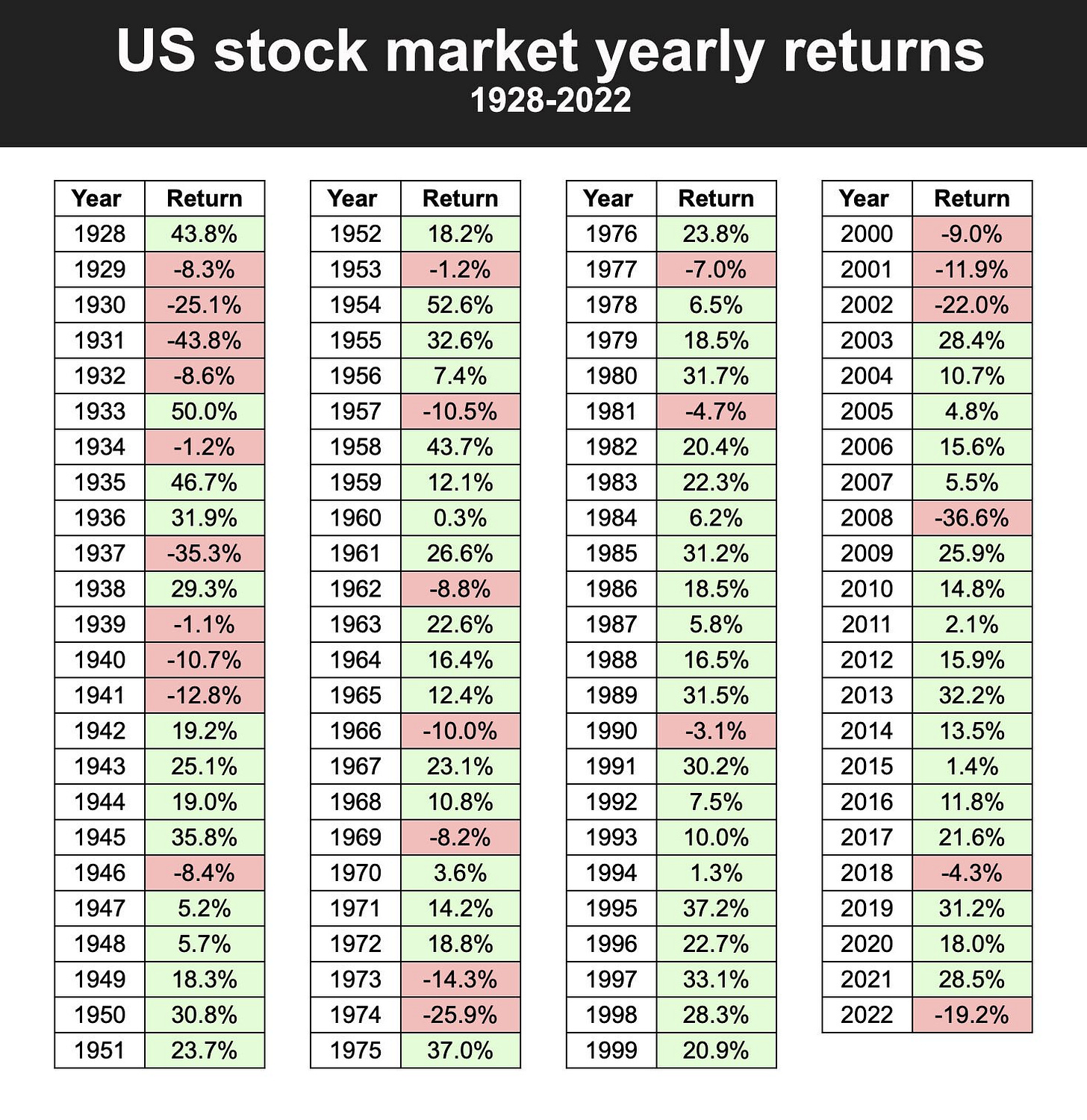

Right now, we can't appreciate it with the importance it deserves because we are living through it at this very moment, but years like this are EXTREMELY RARE in the market. We’ve become accustomed to the pain and corrections, but it's not common to see years like this.

To put things into context: Over the last 47 years of the market, from 1975 to 2022, there have only been 2 years where U.S. stocks had declines greater than 19% like in 2022. Only 2002 (-22%) and 2008 (-36.6%) had worse returns, and 2002 wasn’t that far behind in terms of losses.

But I’ll go even further. The two years that come in below 2022 are 2001 (-12%) and 2000 (-9%). That means, the next worst year (out of the last 47 years) in terms of returns is 7% worse than this year. Not even close.

In other words, only in 6% of the years will we have opportunities to buy quality companies at such low prices, but this brings a problem...

The Paradox of Choice

Imagine this scenario: The entire market is falling equally.

You see the Mega Caps of the U.S., the Small Caps of Europe, the Micro Caps internationally, all falling indiscriminately. It doesn't matter whether they are growth or value stocks, large or small, domestic or international. They were all dropping and reaching valuations not seen in the last 5 years.

At first, it seems like a blessing, right? After all, widespread declines mean more options to invest in. Well, no.

The Paradox of Choice states that the more options we have, the harder it is to decide. In other words, the greater the number of options, the more we reflect on which one to choose, something that is explained by the simple fact that there is more information waiting to be processed and evaluated by our brain.

This year, it was extremely difficult for me to decide where I wanted to be invested because there were countless options of different styles, sizes, and countries. This, combined with the fact that I was still discovering the investment style that made me feel most comfortable, led me to rotate my portfolio much more than I would have liked. The good news is that by mid-year, I had finished consolidating the type of stocks I want in my portfolio.

I could sum it up as follows:

Companies that offer me annualized returns of at least 15% over the next 5 years, according to my estimates.

Quality companies based on the ratios I’ll show later.

A concentrated portfolio with only 6-12 stocks.

For everything else, I am agnostic to country and size, as long as they meet the three aspects above.

So, this brings us to the next point: the ratios of my portfolio, the stocks that make it up currently (including a major sale due to fundamental changes I hadn’t noticed), and the returns.

Relevant movements during 2022

At the end of this year, I began building a second portfolio focused on finding Deep Value situations and Workouts to help me stay uncorrelated with market movements. This is because, in the past, I made the mistake of having most of my portfolio move in sync with the market, since they were all companies with similar qualities (mainly tech).

Patreon and Substack premium members already know which stocks make up this second portfolio, but I’ll show it again in this post in case anyone missed it. Now, let’s move on to a pretty relevant change: the sale of a stock that had a lot of weight in my portfolio.

The big sale of the year: Why did I sell Converge Technology?

Well, I first learned about this company from Alex Estebaranz in November 2021 when I hadn’t yet decided to create my own investment theses and was doing fairly superficial analyses, which already introduced a bias from the start, though I don’t blame Alex for that.

I stayed invested for a good amount of time because the company occasionally presented triple-digit growth, operates in a growing market, and to date, I think the management team is very good. However, that made me overlook some of its downsides. Specifically, here’s what concerns me the most:

It depends on issuing shares and debt to grow, because despite being in a high-growth sector, the company has very low organic growth rates of between 5% and 8%.

Its Free Cash Flow margins are quite low compared to some of its peers and competitors.

The sector it operates in doesn’t usually have high ROCE, and still, CTS has lower returns than some of its peers, even after normalizing it with the margins that could be expected in the near future.

They constantly show Adjusted EBITDA (as if traditional EBITDA isn’t already adjusted enough), and they even use it to provide guidance and future projections.

For all of these reasons, I consider Converge to be a low-quality company that is far from fitting into my investment philosophy. A better way to see this is through the 8 Checks I apply to my Watchlist and Portfolio (I highly recommend doing something similar yourself). These 8 Checks consist of:

P/E ratio lower than 25.

FCF Yield greater than 5%.

ROCE and FCF ROCE greater than 15%.

FCF CAGR growth of 15%.

Margins greater than 15%.

Debt/EBITDA less than 1.5x.

CapEx/Sales less than 5%.

You can adjust these parameters based on your preferences, but they help narrow down your "investable universe," as I mentioned earlier—having more options doesn’t necessarily mean making better decisions.

In my case, if a company meets 6/8 checks, I consider it a good investment option. But if it has fewer than 5, I consider it a low-quality company (unless it can reverse this in the medium term).

From my watchlist, only Converge and Calnex have fewer than 5 checks. In the case of Calnex, this is because it is expensive and they are investing heavily in CapEx. Both issues can be reversed at any time if they reduce investment spending and the stock price corrects. But for Converge, the penalty comes from having low margins, low ROCE, and having grown its FCF per share very little due to the high dilution of recent years. It’s difficult to reverse this, because even in other more mature comparables, margins and ROCE are not usually that high.

I had to say goodbye to Converge with a significant loss of -24%, but I don’t think it’s a good time to be in a company with low organic growth and FCF margins, especially in an environment where issuing debt is becoming more expensive, and issuing shares to make acquisitions would destroy value since the company is trading at very low multiples.

I don’t see any catalysts for the market to turn positive on CTS (except for a takeover or merger), and I also don’t know how they will continue to grow at double digits if it’s no longer easy to make acquisitions. That’s why I preferred to sell, accept my mistake, and move that capital into companies from my Special Situations portfolio.

Current portfolio

I closed this year with two portfolios: One part dedicated to Quality Growth, which currently represents more than 70%, and another part dedicated to Special Situations/Deep Value, which is 27% of my positions.

Sizes

Most of my portfolio is in Micro Cap stocks, i.e. stocks with a Market Cap of less than $500M.

Small Caps (between $500M and $2B) represent 35% of my portfolio.

I own 12.5% in Mid Cap (between $2B and $10B).

Another 13% is in Large Cap (>$10B), although the largest company has a Market Cap of only $13B.

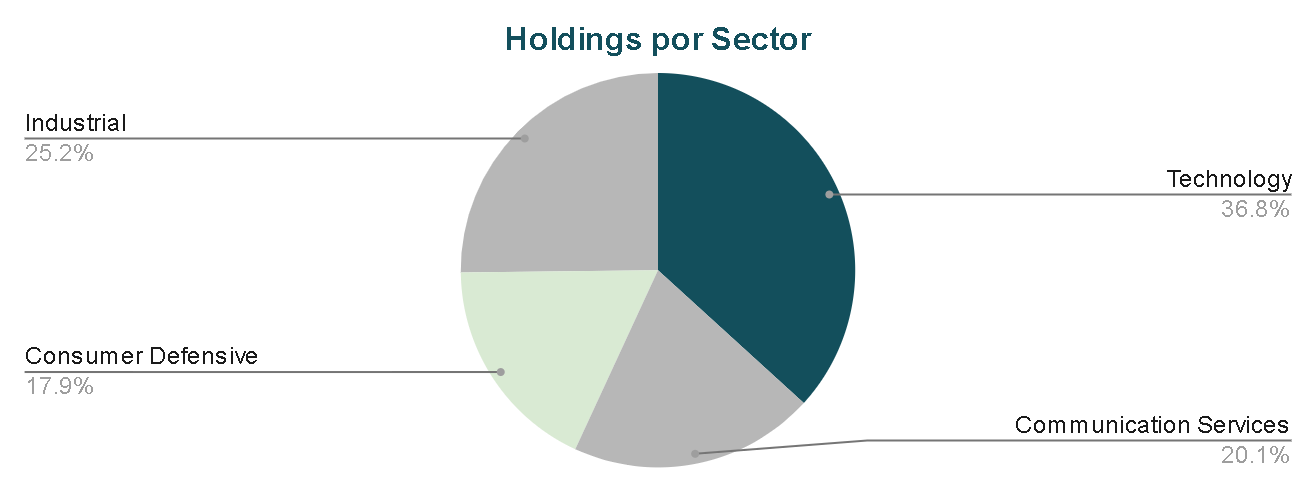

Sectors

I‘ve been very careful about the sectors I invest in, as I used to have a lot of technology. Nowadays it is only 37%.

The rest is between Defensive Consumer, Industrials and Communication Services, although the latter two are mostly made up of Workouts.

Holdings

Quality Growth: SDI Group, Fleetcor Technologies, Sprouts Farmers, HireQuest, PubMatic.

Workouts: RCS Mediagroup, Dole, Berry Global, IDT Corporation, Thryv Holdings.

Non-Binary (?): Luceco.

Quality Growth Portfolio

SDI Group: A UK company that grows mainly through acquisitions, but with the excellent characteristic of margins and ROCE above 20%. In addition, organic growth has already been close to 10%, so if it stops making acquisitions, the company's situation will not be greatly compromised. It has a very good CEO who cares more about the shareholder than the compensation he can obtain, and he has been in the position for a while and during that period the company has done well, so I hope this continues for many more years.

Fleetcor Technologies: I will soon publish the full thesis exclusively for you, but I can tell you that it is one of the companies with the highest revenue forecast thanks to its subscription model and for some reason the market offers it to you for less than 15x earnings. The CEO is very aligned with the shareholders, so much so that during 2020 he decided to suspend his stock and cash bonuses so as not to dilute the company or affect margins during the uncertainty caused by COVID.

Sprouts Farmers: It's the company that's been in my portfolio the longest and one that lets me sleep the most peacefully. I've talked about it quite a bit here on Substack, but it's basically proven to have pricing power and the ability to manage its costs without losing customers during crises.

Despite this and having the best margins in its sector, the market doesn't apply any premium to its valuation like it does with Walmart, for example, so you can currently buy it for 14x earnings, which in my opinion is extremely reasonable.

HireQuest: There are very interesting things behind this business that operates franchises to provide temporary staff. Although historically it is a sector sensitive to the economic cycle, at the same time there is a phenomenon of lack of qualified personnel thanks to the increase in adults in their prime age who decide not to work or earn money through the internet. This generates an interesting situation of high demand and low supply, which could remove that cyclical component that is related to jobs.

I was lucky to form a position when it was below $14 USD and I plan to increase it soon, since it is trading at about 13-14x its FY 2022 earnings.

PubMatic: It is a company that is dedicated to providing inventory to the largest number of potential buyers possible within digital advertising. It is somewhat complex to explain, that is why I am planning to write an exclusive thesis where I will show how the digital advertising ecosystem works, since there are many more members than it seems.

So PubMatic is one of those companies hidden behind the scenes of this ecosystem, which causes the market not to understand it and offers you a company that has doubled its profits in the last 4 years while maintaining a ROCE of more than 15% at 13x profits!

A real market inefficiency, in my opinion.

Workouts Portfolio

RCS Mediagroup: A deep value position in the company that owns very strong brands such as El Economista, Marca, Expansión or La Gazzeta dello Sport. I have a somewhat short exclusive thesis written on Substack and Patreon, so I may have to make a more complete update, but as you can see, it entered my portfolio with almost 7% weight.

The special situations of Dole, Berry Global, IDT Corp and Thryv Holdings are also recently explained on Substack and Patreon, in case you want to see in more detail what each one is about and what is the target price I have for each one. All with approximately 6.5% weight, except for Berry which I’m waiting for to correct a bit.

The “Non-Binary” Luceco

The Luceco case is curious, because I consider it both Special Situation and Quality Growth, so I will place it as a bit of both while I decide what its category is.

On the one hand, I expect there to be a strong multiple revaluation in the next few years when profits begin to stabilize, since the problems that affected it are going away and the market will soon realize that.

But, on the other hand, we have a company that has consistently generated ROCEs above 25%, with the exception of 2018. It also has little debt, does not require much CapEx, pays dividends and has improved its margins year after year for the last 5 years. I don't know what you think, but for me that is synonymous with quality, but due to its industrial sector and its sensitivity to the economic cycle, I don't know if I want to hold it in the long term.

I also want to add that the more I read about the management team, especially the CEO, the more I like the company. In addition to being very aligned with shareholders and owning almost 25% of the company without being the founder, John Hornby has stock options tied to Total Shareholder Return. This is measured by the stock's performance + dividends, so his best way to own these shares is by growing EPS while paying dividends. Although this could be dangerous, the company has a minimum CapEx requirement that must be allocated to reinvestment and a maximum percentage of profits that must go to dividends, so this is life insurance against falling into a company that pays an excessive amount of its profits in dividends, or worse, that issues debt to pay dividends.

So I need your help: How would you categorize Luceco? Quality or Value?

Performance

The current positions have given me a return of -5% overall since I bought them and as I mentioned before, I have had many successful sales during the year that more than compensate for the loss of CTS and META.

Unfortunately, I have the shares separated in 2 brokers with two errors: The first one does not provide me with charts with annual returns (GBM) and the second one shows me monstrous losses of -75%, but this is because it takes into account the commissions as if they were part of the purchase price (IBKR), which makes no sense in my opinion. Here is more about my returns in GBM:

I already have plans to keep my own tally of monthly and annual returns for 2023 in my portfolio tracking template so I can provide more accurate data next year, but for now that is the information I can provide regarding my returns.

Edit (5/Nov/2024): Hi, I'm Gustavo from 2024. I recently managed to import the information from my two brokers into a platform called Portseido to calculate my exact returns. As you can see, the 2022 return was -12% thanks to trades from Medpace, Olaplex, Qualys, etc.

Edit (5/Nov/2024): In the following chart, also from Portseido, you can see the prices at which I bought and sold some of these positions. This ended up being quite key to outperforming the S&P500 even in such a negative year.

And well, this is where the review of 2022 ends. In my opinion, I was able to save it quite well and I didn't die trying thanks to the fact that I was buying cheap and taking advantage of market rebounds to sell some positions that recovered quickly in a short time and weren't exactly cheap, such as Adobe, EPAM, Qualys, Medpace and Olaplex.

Disclaimer

All contents of this blog are for informational purposes only and under no circumstances, whether express or implied, shall be considered investment, legal or any other advice. Please do your own research and due diligence.