Investing in Mexican Airports

The second most visited country in the world.

In this occasion I’m bringing my second English research, this time about something I know quite well: Mexican airports.

This is the story of an unusual oligopoly that I just found out and wanted to share it with you. So… let’s start with this short research.

Business Model

Grupo Aeroportuario del Centro Norte (OMA) has concessions to develop and operate airports in Mexico. The company operates 13 international airports in different cities. It also operates the NH Collection Hotel at Terminal 2 of the Mexico City Airport and the Hilton Garden Inn hotel at the Monterrey International Airport.

Grupo Aeroportuario del Sureste (ASUR) is the holder of concessions for airports in the southeastern region of Mexico. The company operates 9 airports in Mexico, 1 in San Juan (Puerto Rico) and another 6 in Colombia, so this Group has better geographic diversification than OMA.

The last airport on this list is Grupo Aeroportuario del Pacifico (GAP), which operates 12 airports near the Pacific coast of Mexico plus two airports in Jamaica.

Sales Distribution

According to Mexico’s Airports Law, revenues must be classified into Aeronautical Services and Non-Aeronautical Services.

Aeronautical Services: These are those revenues related to essential activities for the operation of the airport. Includes charges to passengers, aircraft parking, passenger gateway, airport security services, among others.

Non-Aeronautical Services: These revenues are those that are not essential for the operation of the airport. Can be the leasing of spaces to restaurants, airlines and commercial stores that are located inside the airport.

There is a third category that is often called by different names, either “construction” or “improvement of assets”. The important thing is that these are reported as "income" and are related to the improvement of the facilities of the airport, but also have the same cost of sale, so they do not generate profit or loss.

OMA

2021 revenues were 76% from Aeronautical Services and the remaining 24% from Non-Aeronautical Services.

Regarding sales by airport, 55.3% came from Monterrey, since this is the largest city in northern Mexico, 10.4% from Culiacán and the remaining 34.3% came from all other airports.

ASUR

Revenues for 2021 were 59% from Aeronautical Services and the remaining 41% from Non-Aeronautical Services.

About the sales by airport, 82% came from Cancún, 5.8% from Mérida and 12.2% from all the rest. So there’s a clear dependence on the Cancun airport.

GAP

Revenues for 2021 were 76.8% from Aeronautical Services and the remaining 23.2% from Non-Aeronautical Services. The sales by airport, 26% came from Guadalajara, 18% from Los Cabos and 56% from all the rest, so we could conclude that this is the airport that depends least on a single city and is more diversified.

Addressable Market

Tourism - Key for Growth

The recovery of tourism has been a slow process that during the past year began to show signs of improvement, however, the impact of the pandemic on tourism activity has meant changes not only in the modalities of practicing tourism but also in the flows of tourists around the world. These were the most visited countries during 2021 according to figures from the World Tourism Organization (OMT):

Mexico had 32M tourists in 2021, being an economic impact of ~$18B dollars on the country. Revenues from GAP, ASUR and OMA were $2.2B (with the three combined) during that same period, which represents ~12% of tourism spending. Also between 2018-2021 sales represented ~12.5% of tourist spending.

By 2022, global tourism is expected to normalize, so Mexico expects an economic impact of ~$24B dollars, meaning $2.9B that could go in income for airports, representing a 30% increase in revenues compared to 2021.

Oligopoly

We can also see the list of the 10 most visited airports in Mexico during 2021:

Mexico City (AICM)

Cancún (ASUR)

Guadalajara (GAP)

Tijuana (GAP)

Monterrey (OMA)

Los Cabos (GAP)

Puerto Vallarta (GAP)

Bajío (GAP)

Mérida (ASUR)

Culiacán (OMA)

With this we can get an idea of the monopoly they have in the most visited cities in the country. In the following image we can see it located geographically: The purple points correspond to ASUR, the red ones to OMA and the green ones to GAP.

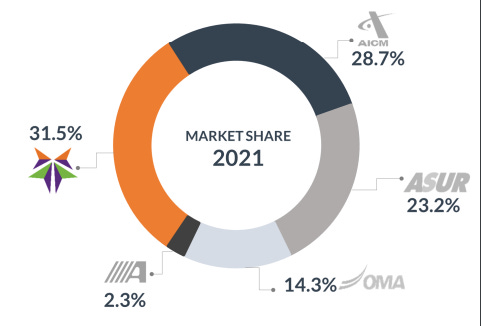

In terms of market share, GAP had 31.5% of passengers, ASUR 23.2% and OMA 14.3%. An oligopoly of 4 airport groups that control 98% of the market (if we include AICM, which is an International private airport in Mexico City).

Key Ratios

In order to get an idea of the fundamentals, I made a table taking some relevant data, although I would still recommend that everyone review the historical data on a case-by-case basis.

The airport that has grown its revenue the most in the last 10 years was ASUR, which has Cancun as its main airport. However, they’ve all had growth more than 11% CAGR, even taking into account the slowdown due to the 2020 crisis.

The Gross Margin is higher than I would have thought. 57% in the case of OMA, which is the one with the highest gross margins, but ASUR has the best EBIT margin.

They all generate an ROIC above 13%, which shows us that there are competitive advantages formed.

The Capex is very high for all three, although this is something that could be intuited given the nature of the business.

We can also see that the average valuation metrics are close to PER 25x and EV/EBITDA 13x for the last 5 years.

Today, on June 15th

OMA: PER 16x and EV/EBITDA 11x

GAP: PER 20x and EV/EBITDA 12x

ASUR: PER 17x and EV/EBITDA 11x

On first instance, all of them seem slightly undervalued.

Strengths and Risks

✓ Cost Advantage: OMA, ASUR and GAP groups have national scale, so they can obtain more favorable conditions when negotiating with airlines, restaurants, hotels, etc.

✓ Barriers to Entry: Airports work under concessions that are granted by the government and to be obtained, a series of regulations must be met, this means that not everyone can come up and build an airport simply because they woke up wanting to compete with ASUR , for example. This gives them the characteristics of a monopoly in their respective cities.

✓ Switching-Cost: This cost would be related mainly to the government, since in order to grant its concession to another airport, there would first have to be a finished infrastructure that could compete with the current airports. As you can guess, this is not a simple task that can be done from one day to another.

✕ Country: México is not the friendliest country when it comes to economic policy. For example, we could name the two projects that were canceled by the actual government in 2019 and 2020 (an airport in the middle of construction and a Constellation Brands brewery), so this would be an added risk.

✕ Currency Risk: Income comes in Mexican pesos, Colombian pesos and, in general, currencies weaker than the US dollar. This means that in the long term there’s normally a depreciation between the currencies of the airports and the dollar.

✕ Sensitive to Economic Cycle: Airports are related to tourism, so they can be somewhat cyclical, so a recession or a slow economy could bring a decrease in passengers, which would result in a decrease in revenue growth.

Final Thoughts

If you give me to chose one of them, I’d probably go with the three. Is just impossible for me to chose one, since the three have different features.

GAP: Has been growing more, with higher margins and market share.

OMA: Highest ROIC, less debt, cheaper in PER.

ASUR: If kind of the middle ground between the three, but also is less capital intensive.

Pros and cons, but there’s an amazing oligopoly created with high entry barriers and although economy is delicated right now, tourism expects a full recovery on the next year or two, which will bring tailwinds for airports.

Now I’d like to know your thoughts on this, shortly than usual, research. Did you like airport’s business model? What airport would you chosse?

Disclaimer

All the content of this blog is for informational purposes only and in no case, whether express or implied, shall they be considered investment, legal or any other advice. Do your own research and due diligence.

really enjoy reading your analysis. thanks for sharing!

Hola! This is great analysis. These sound like the types of companies I like to invest in (high barriers to entry, excellent returns & very nice dividend yields), plus the tailwind to growth from Mexico being the second most visited country in the world.

Not that this has much relevance but, my wife is from Mexico, she grew up in Mexico City and we visit a couple times a year.

I am based in the US but, can trade on international exchanges through Fidelity.

Can you tell me what the local tickers are? I looked them up on Yahoo Finance and came up with GAPB.MX, OMAB.MX, ASURB.MX. Do those look right?

Also, while I have you here I was wondering your brief thoughts on a Mexican stock I own: Bolsa Mexicana de Valores, S.A.B. de C.V. (BOLSAA.MX). Perhaps you might do a write up on it in the future? I really like financial exchanges and also own $ICE and $CME in the U.S.

Keep up the great work!

Gracias,

Dan