La traducción de esta tesis viene por petición de mi compañero “From $100K to $1M”, que también es accionista de Sprouts. Les recomiendo que también se den una vuelta por su Substack, donde muestra su camino intentando convertir 100 mil dólares en 1 millón, mientras nos cuenta sus aprendizajes, experiencias y actualizaciones de portafolio.

English Version of my Sprouts Post

I live in Mexico, specifically on the border with United States. So one day I went to visit a supermarket chain that I already knew about but have never been to. What's that supermarket? The name was “Sprouts Farmers Market”. I must admit the shops are flashy, they were decorated like it was a farm lol.

But the most interesting thing was that the whole theme of the supermarket was organic, healthy and even plant-based food. I also found the great products of Tattooed Chef, which are a bit difficult to find. As you can imagine, that was the final crush and as a result now I have Sprouts as a top holding company in my portfolio. Life gives you surprises.

So I want to talk a little more about this small American store that brings a different concept to the table and that is in a growing and totally anti-crisis sector (there’s nothing more anti-crisis than human feeding)

Business

What is Sprouts Farmers Market?

As I mentioned earlier, Sprouts SFM 0.00%↑ is an American supermarket chain focused on fresh, local, and healthy food. It was founded in Arizona in 2002, so it's fairly new to the market and has more opportunity to grow. As of March 2022 there are 374 stores throughout the United States and they have the plan to continue growing the number of stores at a rate of 10% per year.

In addition to selling products from other brands, they also have their own private label, which in 2021 represented 16% of their sales and has been growing, just in 2018 it was only 13% of sales. Their private label products bring them better margins and they can also sell them cheaper, so there’s an opportunity of a win-win situation with Sprouts and clients, something like Costco’s business model.

New Strategic Plan

Since 2020, Sprouts began this process to re-invest and improve the profitability of each store. The plan is focused on grow smart, based on 5 pillars:

“Win with the target customer”: This point is based on giving Sprouts a specific approach that provokes more loyal and profitable customers for the brand, developing a long-term relationship.

As I have a degree in marketing, this point was very interesting to me, because they are leaving aside the image of a simple supermarket to start connecting with their customers. This will give them a very important brand power in the future, something like what Apple did to differentiate itself from other smartphone brands.

“Refine the brand and advertising”: Closely related to the previous point, they are focused on giving advertising a better look and they’re making better offers for customers that are not just pointless “50% sale” or something like that traditional discounts.

The best way to understand this is by looking at this comparison where you can perfectly see the new approach to advertising. More visual and smarter sales.

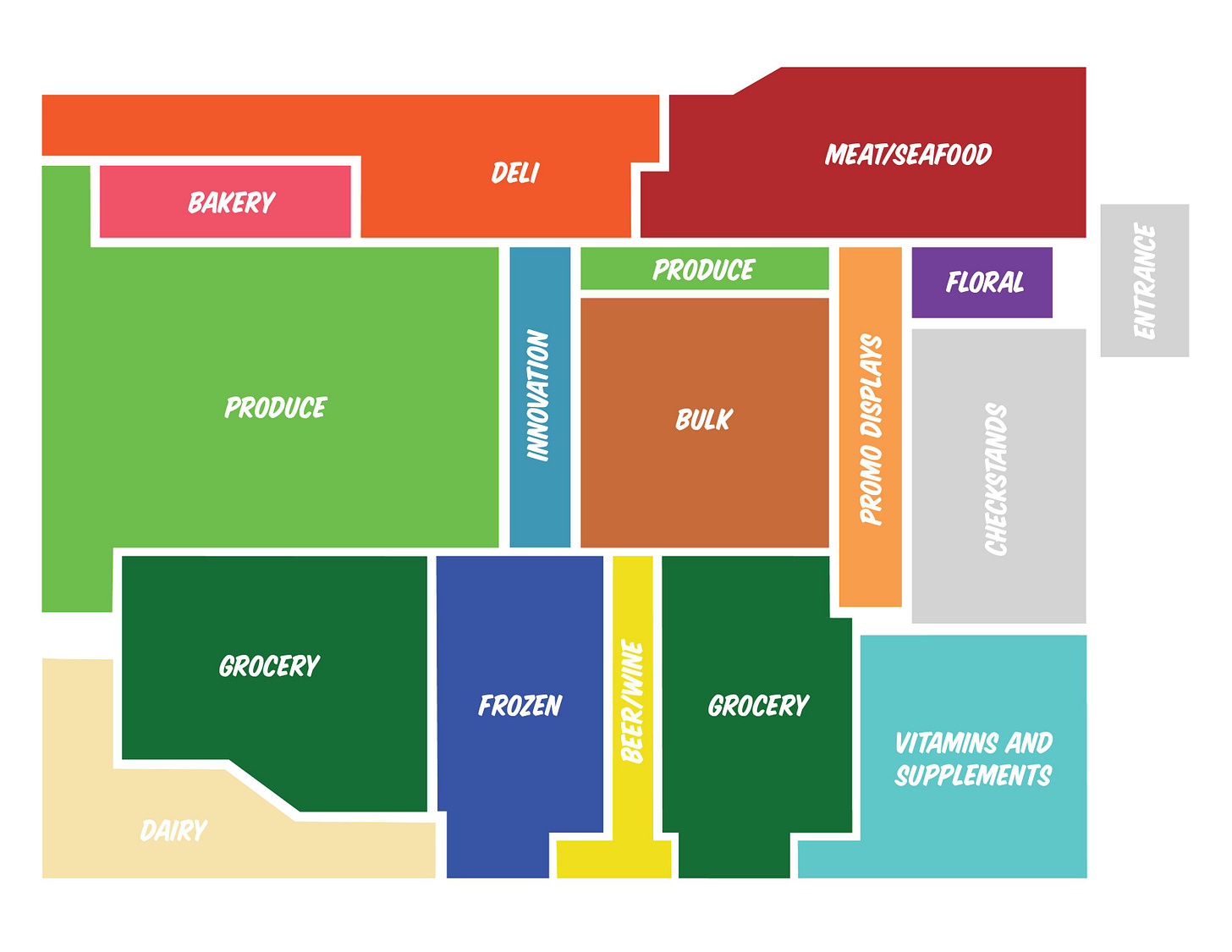

“Update format and expand”: Sprouts redesigned the layout of each store and the way products are organized within it, making them smaller, between 2600-2800 square meters. But the important thing is that by doing this, it is estimated that the costs of opening each store are reduced by 20%, in addition to the fact that customers seem to be happy with the new design. This reduction in costs and increase in the profitability of each store, should be seen in the operating margins during these years and will be essential to improve profits.

In this design, 20% of the store is dedicated to private label products, being higher than what competitors do. The stores are designed with an open plan with low shelves, trying to provide the customer with an easy purchase, since they can have a panoramic view of the entire store.

“Create advantages in the supply chain”: The idea is that there should be a distribution center less than 500 kilometers (≈300 miles) from each Sprouts store, this would waste less food during the distribution process and costs of transportations are gonna be lower too, making supply chain more effectively.

During 2021 they managed to open two new distribution centers, which would leave about 85% of the stores with a distribution center less than 500 km away.

“Meeting our financial objectives”: The long-term financial objectives proposed are to reduce costs, increase the number of stores, improve margins, grow profits by 10% and increase ROIC. We’ll see them in the Key Ratios segment.

Those would be the five bases on which Sprouts expects to grow, as I mentioned before, it is intelligent and planned growth, which in the short term could reduce margins or profits, but in the long term the results will be reflected. A stage of restructuring.

Addressable Market

The sector and market is another key to future growth, as the organic food sector is expected to grow at rates of 12% CAGR over the next 5 years to reach $95B, driven by the awareness of society regarding healthy eating and the support of governments for this cause.

As for Sprouts, they estimate that in the United States there is a potential market of $1.2 trillion dollars spent by consumers who buy products to cook or eat at home, of which SFM still has a very small market share, less than 1% and Just by increasing that market share to 3%, sales could double.

Not only could they reach people who are looking for organic and healthy food, they could also change the habits of other people who are not yet on that style of diet.

Key Ratios and Peers

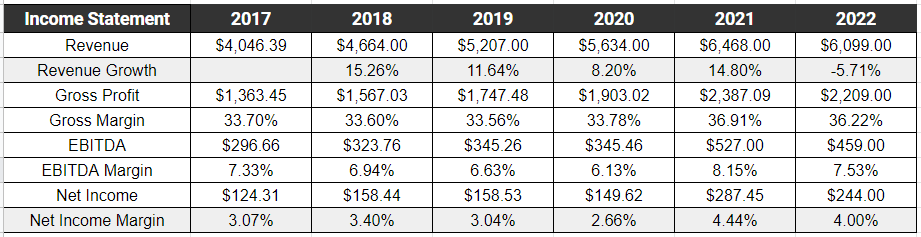

Revenues have grown on average 8% since 2017. In 2022 they did not grow, this was because the comparable base of 2021 was very “inflated” after the confinement of 2020 that caused people to cook more at home. But now growth has already normalized.

We see how the EBITDA margins have been increasing to the current 36%. This shows how they are truly being more efficient.

The Net Income is quite stable between 3 and 4% of sales.

Some additional data:

The capex/sales is 3% on average. It is not a capital intensive business.

ROIC has been close to 16% on average.

The ROE, meanwhile, has been at 26%. High returns.

Sprouts Peers

To contrast the current situation of SFM, we can analyze its main competitors and their Key Ratios. We'll take a quick look at Kroger , Albertsons , and Walmart .

The Gross Margin of Sprouts is much higher than the rest. A higher Gross Margin means that it costs SFM less to produce and sell its products than its peers.

This higher Gross Margin is also reflected in EBITDA, although we must remember that SFM's margins will be compressed during this restructuring process. The long-term goal is between 8 and 9%.

Sprouts ROIC is in the average of the competitors, just being lower than Walmart’s ROIC.

In terms of debt to EBITDA, it also has a lower ratio than its competitors, with the exception of Walmart. In this type of business, operating leverage is quite common given its anti-crisis business characteristics and predictable income.

Despite being a higher quality business, Sprouts is trading cheaper than average on a P/E basis, second only to Albertsons.

As we can see, we are in front of a higher-quality competitor within its sector, in the present but also in the future. We could expect that in the medium term these ratios will improve even more as the results of the new strategic plan are reflected.

Management Team

Experience in industry

The management team is very experienced in the retail sector.

As is the case of CEO, Jack Sinclair, who has been at Sprouts since 2019 and he was the director of the Walmart food section during 2008 to 2017.

In this image we can see the management team and their previous experience, where it is noted that they were mostly related to the supermarket sector, so they are experienced people in the sector and have a lot to contribute.

Little skin in the game

One of the aspects that I least like is the ownership of shares of the management team in relation to their salary, since they all receive a higher annual salary than the number of shares they own, which together do not add up to even 0.5% of the total shares of the company, in addition to having quite high salaries compared to the industry, as is the case of the CEO who is getting paid $8.5M yearly, when the average for the size of the company and sector is $5.3M.

This does not mean that they will not put effort into their work, but it is already a negative aspect that they do not have their assets in the same place as the shareholders.

Capital and Debt Management

Although they do not own a large number of shares, they have proven to be efficient in capital allocation, an example is that the number of shares has been declining notably at a rate of approximately 5% per year, having aggressive share buyback plans at current cheap valuations. This creates shareholder value, as with each buyback program every shareholder owns a larger portion of the business.

Regarding dividends , they have never distributed and it does not seem that they will distribute in the near future either, since the Free Cash Flow is being allocated to the growth of the company and the repurchase of shares. I like that by the way.

Regarding debt , we could previously observe that they have a good Debt/Equity ratio compared to the sector and the Net Debt/EBITDA has been an average of 2.7x since 2016, considering that less than 3x could be an acceptable ratio in the sector.

Strengths and Risks

Moats

Economies of scale , we have already seen the plan they have to continue increasing the number of stores, which would give them an advantage of scale in the future, which would reduce their costs and increase their margins, which are already higher than the industry.

With the new strategic plan, the distribution centers would be located less than 400 km from each store, creating a superior supply chain that cannot be easily matched by the competition, since it will require years and investment.

The brand power that it is generating will position it higher in the minds of consumers who seek to consume healthy, making a comparison, we could say that Sprouts is earning a name as if it were the Disney of healthy supermarkets.

Risks

Management team with little skin in the game and with considerable turnover in recent years.

Not being able to achieve the ambitious strategic plan that they have in place, especially if the competition begins to eat away their market share.

Valuation

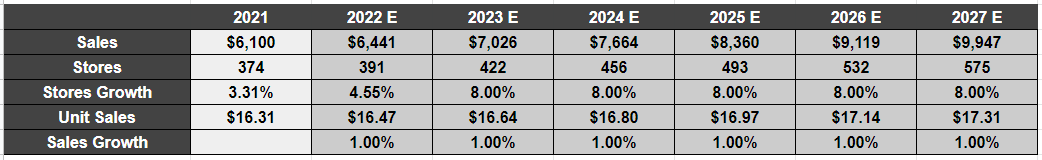

We will take into account stores and revenue per store. The management team mentioned that the plan was to grow the number of stores by around 10% for the next few years and the revenue per store between 0-2%. However, this plan did not take into account the problems of the supply chain, which will cause new stores to grow less during 2022, between 4 and 5%, and by 2023 the number would be closer to that objective of 10% per year.

To be conservative I will not faithfully take 10% new stores per year and I will leave it at 8%. This would give us estimated sales for the year 2027 of almost $10B. I consider this to be a fairly conservative estimate since for Sprouts there’s cheaper to build each store and the new store design is also more profitable, so I believe that sales per store (or comparable sales) will grow more, as will the number of stores.

I'm going to take into account the share buybacks that have been 5% historically and that the management team has mentioned that they will continue to buy back aggressively and we will use SFM's historical and industry average ratios, which would be 10 EV/EBITDA and 15 PER.

With all this, it would give us a target price for 2027 of $110 USD using EV/EBITDA and $85 using PER, which we could leave as a target price of $95 USD for 2027 using the average of both valuations. The current price of shares is $24, so we would assume a compound annual return of 30% by buying the shares at this moment.

Final Thoughts

As a summary, I could highlight the following points:

✓ Is a stable business and highly defensive, but also has growth because is a small company in full expansion stage.

✓ The strategic plan seems brilliant to me, focusing on growing while making business operations more profitable. This may give a boost to the share price when reflected in future EPS.

✓ Is in a growing market with tailwinds, organic food is not only a growing market, I believe it is also necessary, current human nutrition is not sustainable and a change in the way of eating and treating food is required.

✓ Good fundamentals, clearly superior to peers and that make me think that there really are competitive advantages behind it.

✓ The valuation is really attractive, in part because lately the stock fell 30% from 52 week highs. It could easily be the base of any portfolio.

✕ Little skin in the game of the management team, despite they have been doing things very well and have proven to be very capable. Maybe I shouldn't judge him by his stock ownership, but it makes me uncomfortable.

In any case, I believe that Sprouts is a company that will continue to be part of my portfolio for many years and that I will feel comfortable to have as a top holding, as it has been in recent months. Stable, with good future prospects and well managed.

Now I would like to know your opinion, have you ever been able to visit a Sprouts store? How do you think stock is going to perform in future?

Disclaimer

All the contents of this blog are for informational purposes only and in no case, whether express or implied, shall they be considered investment, legal or any other advice. Do your own research and due diligence.

Wonderful piece and appreciate the shout out 🙏 I think being an organic grocery is both gift and a curse but given how spoiled we became (American) it’s more gift.

gracias por compartir, muy bien estructurado el trabajo e interesante, me ha resultado muy interesante las imágenes sobre la publicidad anterior y actual, creo aquí están haciendo un gran trabajo, y los resultados se verán a partir de los próximos trimestres tras la contratación del nuevo director de marketing, dejo un video que puede incluir algún detalle por si consideras es interesante, https://youtu.be/H9FhLfYmnBI , sería de gran ayuda tus opiniones, un saludo y nos seguimos viendo por aquí, este blog tiene ideas muy interesantes