More than once I have come to my nearest AutoZone with my Cruze 2015 needing an autopart change and thinking:

That's why I have a kind of fetish about AutoZone and O'Reilly, they are businesses that solve a big problem, where we rarely would think: "What if I don’t go to O'Reilly and better leave my car broken?". After all the life of your car depends on this service.

Critical services and anti-crisis business models, that however, are also mature businesses with little growth. This is where APR comes into the picture, a small Polish company with a business model similar to AutoZone, but that has grown by 25% in recent years and is trading at only PER 8!!

There must be something very good behind it. So, without further to add, I paste here the image with the company’s logo (sorry, I can't skip the photo of the logo, it's a blog protocol) and let's start the analysis.

Business Model

¿What does Auto Partner do?

Auto Partner is an auto part distributor based in Poland.. The company offers suspension and steering systems, brake systems, an assortment of motorcycles, workshop equipment, timing gears and cooling and air conditioning systems, among others.

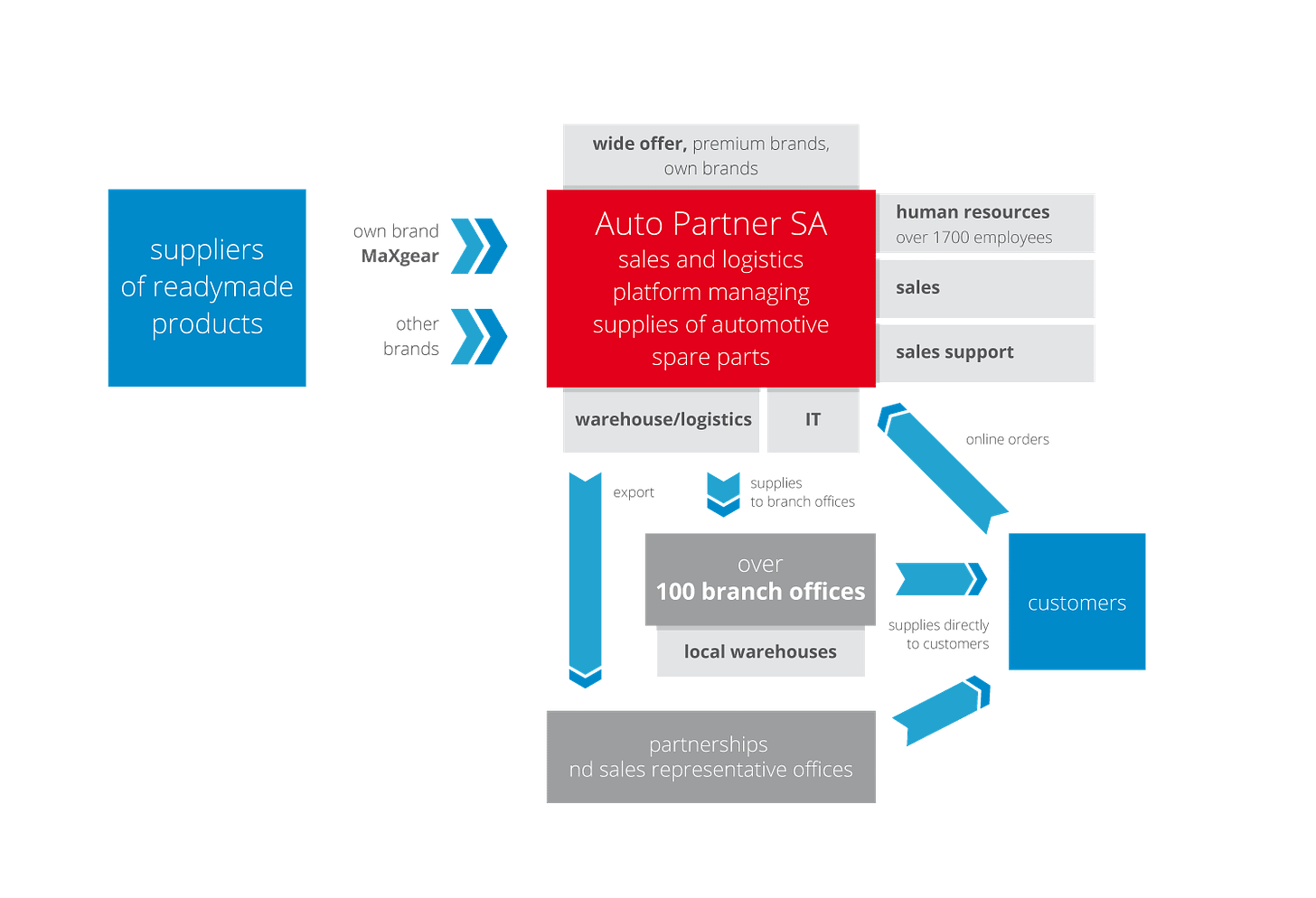

The business model consists on operating the sales of spare parts and providing rapid supplies of the ordered goods. The following image shows the logistics process.

🡲 They have suppliers of different premium brands, including their own brand MaXgear. The offer includes more than 250,000 products.

🡲 The customer contacts Auto Partner, mainly online (about 62% of orders are in this format) and places his order.

🡲 Once the order is placed, Auto Partner has a well-developed infrastructure, both in the form of warehouses and branches, as well as transportation, which allows auto parts storage services to be outsourced while allowing speedy deliveries directly to customers.

Clients

The main customers are repair shops and specialized workshops. There is a third segment that includes non-specialist repairmen and retailers. They currently have customers throughout Europe, and are present in 26 foreign markets, collaborating with more than 350 spare parts suppliers.

This dispersed customer base in Poland and foreign markets requires a customized logistics system that guarantees deliveries several times a day. To fulfill customer orders in accordance with Group standards, products are delivered via more than 700 local routes and shipped 2-10 times per day.

To meet this demand, Auto Parter currently has 103 branches in Poland, one warehouse in Prague and another one in Poland and two distribution centers in Poland. They also have a subsidiary and warehouse in the Czech Republic, which gives them greater geographical expansion.

MaXserwis - An interesting line of the business

In addition to the above, Auto Parter has a line called MaXserwis, which is a nationwide network of independent auto repair shops.

APR contacts independent workshops in Poland and they start operating under the MaXserwis brand, this network cooperates with car repair shops, body shops and paint shops. Once the shops join MaXserwis it offers support to the owners so that their workshops can become recognizable and customers are sure of the quality offered, they also provide them with different services such as:

Technical software.

The possibility of using a free technical hotline.

Consulting specialists in the field of vehicle repair.

Numerous trainings to which auto mechanics learn to repair suspension and car engines.

Training is also included on issues related to the replacement of certain vehicle components that are more complex to attend to.

This does not mean that Auto Parter will own the workshops, but rather makes them more profitable and provide better service.

So what do they gain from all this? Well, the owners of these small workshops become customers, and every time they have to repair a car they use the Auto Partner service. A win-win relationship between both parties and customers show a certain loyalty towards the brand while provide recurring revenues.

Growth Plan

To continue growing, the group has four growth strategies:

Have an increase in scale in its operations, for example, through improving the distribution network with the creation of new branches and logistics centers (also used to serve foreign markets) or through expansion in foreign countries.

Greater product diversification, expanding the range of spare parts offered.

Increased profitability, for example, through the introduction of new own brands, including those in the premium segment. Increase in the scale of operations, improvement and development of IT solutions (allowing greater cost control).

Expansion of sales in foreign markets.

Market Overview

This market is usually quite anti-crisis, since generally when there is a recession or there is greater uncertainty in the income of families, it is preferred to repair the used car that is already available than to buy a new car. But even when the economy is doing well, spare parts are still necessary, so we are facing a totally defensive sector.

Clearly, this is a fairly mature sector, so a large global market growth is not expected, barely 3% annualized by 2025. However, in the case of Poland, the expected growth is more than 7%, being a fairly fragmented where there are many small competitors that do not have a large market share.

Auto Partner is currently the leader in this market and estimates a share in Poland of between 9-10%, so we would be talking about a potential market of more than 21M Polish Zlotys in Poland alone (something like $5B USD) and for the European market in general it would be higher than $160B TAM.

Average Vehicle Age

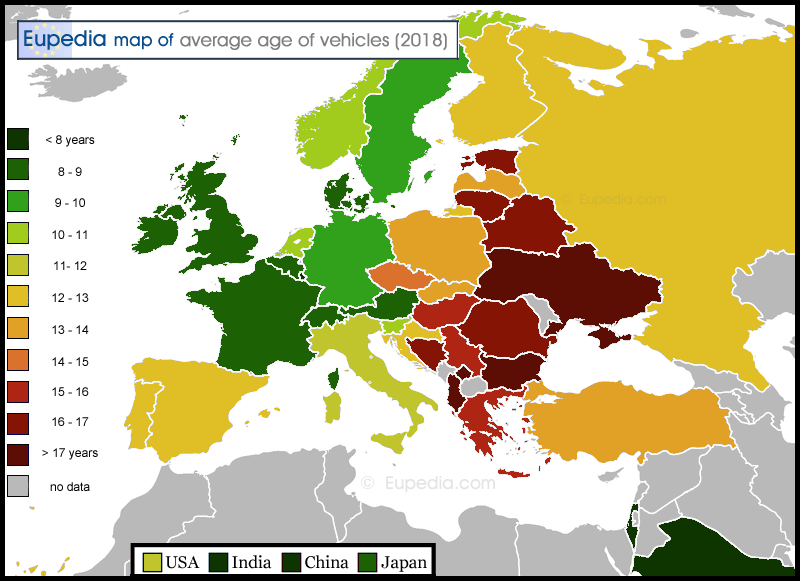

The main growth factor of the auto parts market is the average age of the vehicle.

In Poland, most people own the same vehicle for a longer time. Therefore, car manufacturers around the world are focusing on improving the average service life of their vehicles through the use of high-quality parts. In addition, the rising cost of vehicles is discouraging consumers from buying new vehicles and servicing their current car instead.

All of these factors are increasing the average age of vehicles, increasing the need for regular vehicle maintenance and the replacement of various automotive parts, such as tires, lubricating oil, and other automotive components. Therefore, the increase in the average life of the vehicles is expected to support the growth of the market. As we see in the image below, the average age of vehicles in Poland was between 13 and 14 years and has now grown to 14.1, this would favor Auto Partner’s business.

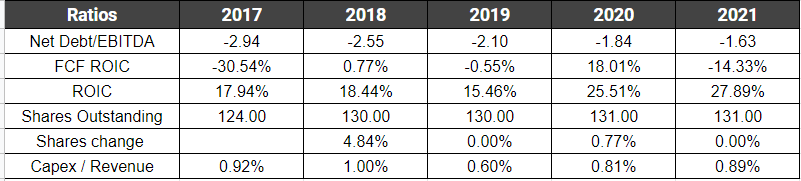

Key Ratios

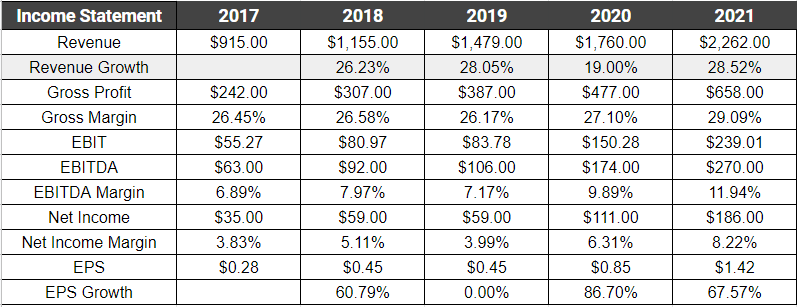

We can see a great evolution in sales, even during the worst of 2020 they grew at 13%.

The EBITDA margin grew from 6.23% to 11.94% in 2020. They’re improving the efficiency of its operations, making wider margins.

The Net Income varies a lot, it is not stable although I could understand it in the case of a relatively young and small company. The average of these five years has been 6%.

They have more cash than debt, negative Net Debt/EBITDA ratio and generally have twice as many assets than liabilities.

A high ROIC/ROCE and becoming higher every year. Not the same to FCF ROCE, since they’re using the whole Cash Flow to inventories, because they’re growing a lot.

Almost no share dilution.

The capex with respect to sales is very low, less than 1%. Is a Asset Light business that does not require much investment to continue its operations.

Management

Skin in the game and experience

The founder, and chairman of the board of directors, has been in the company for more than 15 years and has more than 22% of the shares of Auto Partner, which represent close to $100M dollars. So he’s totally align with the shareholders and has a large part of its assets in the company.

Katarzyna Gorecka, a member of the supervisory board, is the majority shareholder and owns almost 27% of the company's shares. More than $119M dollars in shares.

Capital Allocation

Currently the board pays a modest dividend of 0.10 zlotys per year, a dividend yield of 0.65%.

Regarding the dilution of shares, as I mentioned before, it has been practically null, growing less than 2%, compared to the 50% growth of EPS. In addition, the debt has always remained negative, being able to pay absolutely all of it only with its short-term assets.

In general, conservative capital management dedicated to continuing to grow organically.

Strengths y Risks

Moats

✓ Scale advantage: Mainly in Poland and nearby areas. Much of this scale advantage comes from the MaXserwis line of business where it is growing massively among small independent workshops, estimated to number over 19,000 in Poland alone.

✓ Brand: The Auto Partner and MaXserwis brand has a good reputation and is associated with quality, making it easier to raise prices and negotiate with customers.

✓ Growth in a market that is not growing. Peter Lynch liked this type of company, since little growth means that there are not so many competitors attracted to that market, so it will be easier to generate scale and good margins within this market.

Risks

✕ Currency risk: Most of the income is in Polish zlotys, which is not a very strong currency.

✕ This is not related to the company, rather to the stock, because is quite illiquid, capitalizing at less than $500M dollars.

✕ Little financial information: In fact it was a bit more difficult for me to find information for the research, due to the Polish language and because I could not find something similar to an annual or quarterly report of the company.

Valuation

For the valuation I’ll take into account the factor of the historical growth of 25% and, as I mentioned before, there is a lot of potential market to access.

To be conservative, I will take the 10% EBITDA margins, although I think it could be higher in the future, close to 15%. Something a bit utopian would be to expect the profit margin to reach 13-15% like AutoZone and O'Reilly, but to be conservative I will leave it at the current 8%.

Bear Case

In this scenario, sales will grow considerably less than the historical, at 12%. Due to this slowdown, the PER multiple that we would pay in 2027 would be 10x and the EV/EBITDA 8x.

This would show a 2027 target price of 30 PLN per share, which, from current prices of PLN 13, would represent a compound annual return of almost 18%.

Lol

Bull Case

The annual growth that I consider feasible for the next five years is 20%, but to have a more conservative valuation, I’ll use revenues growing at 15%.

With an EBITDA margin of 8%, a Net Debt/EBITDA ratio of -2 and paying EV/EBITDA of 10x, we would have a 2027 target price of 43 zlotys.

This, from current prices, would give us an annual return of 27%, even though it is a conservative valuation in terms of growth, margins and multiples. And being a little more optimistic with the sales growth rate, we could expect CAGR returns of around 30%.

Final Thoughts

It is clear that the projections in Excel are just that, Excel projections, since nothing guarantees us that the market will be able to recognize Auto Partner in one, three or five years in the future, because it is still a very small company in an unknown market like the Polish, however I would feel quite comfortable having in my portfolio a company with the following characteristics:

✓Anti-crisis sector, very defensive but adding the growth of Auto Partner that is derived from it’s small size.

✓ A very interesting business model, especially MaXserwis, which is a win-win for both parties and which I love, since this forms long-term quality relationships.

✓ Management team with skin in the game. Businesses run by their founder tend to do well, and even more so when the founder has so much of his assets in the company.

✓ Low risk, good competitive advantages. Maybe I’m leaving some risks that I don’t currently see, but I don’t think there’s a really big risk, since it’s a boring stable business.

Without a doubt, it is a company that I could consider making it a top holding in my portfolio due to its asymmetric condition. Little risk but a great potential future return.

What do you think of Auto Partner? Did you see any risk that I haven't yet?

Disclaimer

All the contents of this blog are for informational purposes only and in no case, whether express or implied, shall they be considered investment, legal or any other advice. Do your own research and due diligence.

Buena tesis, gracias por compartir!

Hola Gustavo! Gran tesis. La veo una buena empresa, pero me cuesta creer que aún siendo muy buena, se llegue a valorar en buenos múltiplos dado el mercado en que cotiza. (Le tengo un gran hate a la bolsa polaca jajaja). En fin, aún así, me llama la atención. Los reportes trimestrales y anuales los encontré. https://ir.autopartner.com/en/reports/ . Este es el link. Si no te deja abrir, busca Auto Partner Investor Relations.