2024 learnings

This is the end of my fourth year as an investor and my third writing these annual letters, which I now value very much because it’s funny to reread the 2022 letter and realize that the pessimism of that time now seems to be forgotten, after two excellent years of investing. I want to once again review what I learned this year, what I expect for 2025, and share my current returns and positions.

I started the year heavily invested in small European companies like Dino Polska, Auto Partner, The Italian Sea Group, SDI Group, and others, but this was dragging me down with the worst performance compared to European indices versus the U.S. stock market. Regardless of whether the European stock market is undervalued or whether there was a bubble in the U.S. stock market, I didn’t accept the excuse of: "Yes, but this European small-cap index is performing worse." If there's an index making more money, I want to be in it or at least compare myself to it—compare myself with the best.

Below, we can see the comparison between the IEV (Europe) and the IVV (United States). The 2% return for the year versus 28% says it all.

It was then, in May, that I began to blend the best of both worlds: small caps and lesser-known companies, but with the backing of the U.S. market, which seemed to be more efficient when it came to valuing companies.

I’d call it something like flirting with the market and its trends, but without falling in love with it. Instead of constantly fighting against the market, I’ve tried to follow it a bit, without falling into the most obvious bubbles like AI or quantum computers, but also without being too contrarian. When Europe has the catalyst it needs to compete with the U.S. stock market, rest assured, I’ll be there, rotating my portfolio toward this new trend with solid fundamentals. But before that, I’d rather avoid pinning my hopes on a turnaround that I don’t know will happen. And when I changed this mindset, that’s when the recovery began, as can be seen in the following image:

Another point that has helped me is stopping the search for the bottom in stocks that seem to be in freefall, especially if these drops come with news that could support this negative sentiment. I believe it’s not necessary to find the lowest point of a stock’s price to have successful investments or multi-baggers; I prefer to leave that task to others. This year, I closed a 112% return on AppLovin in just 3 months. This stock wasn’t coming off a 35% drop nor was it surrounded by bad news; in fact, it had performed 100% in the first 6 months of 2024 and was already showing that the thesis was working. While it may seem counterintuitive, sometimes it’s better to buy what’s already working, just as Peter Lynch once said:

"Don’t cut your flowers to water your weeds."

It’s important to remember that a stock that has fallen a lot can always fall further, and every 50% loss in a stock started as a 10% decline that worsened over time because no action was taken. Also, to recover from a 50% loss, a 100% return is required. That’s how math works. The sooner you cut your losses, the sooner you can buy your next winner, because, typically, a company that’s doing so poorly as to accumulate such a sharp drop doesn’t tend to recover quickly. The cost of sitting on a company with a negative environment, even if it’s temporary, can be high if you’re living in a bull market around you.

Short-termism

A somewhat controversial point is that I’ve been reducing my long-term vision and now I operate based on the next few months. I do this because, in my experience, it’s very difficult to predict what will happen with a company five or ten years down the road. No one foresaw that Intel would lose its leadership position in the semiconductor industry and that Nvidia would replace it. No one anticipated that Figma and AI would emerge overnight to threaten Adobe’s business—a story that’s still unfolding, and we’re not entirely sure of the outcome. This happens in many sectors, and with the rapid pace of technological advancement, it seems that fewer and fewer industries are truly antifragile.

My solution has been to look for good investments for the next 12 months or less. Yes, this is short-term thinking, but I believe it has worked better for me in practice. Some of my biggest bets ended up having unexpected twists along the way that I never saw coming. On the other hand, predicting EPS growth for the next twelve months and buying when there’s room for the valuation multiple to expand has less margin for error and is somewhat easier to predict. That’s how some of my biggest winners of the year (Lifeway, AppLovin, or Hims & Hers) came about. Along with this, I take a lot of short-term precautions based on charts (technical analysis), a method I’ve previously explained in detail in this article, which has saved me from several headaches so far.

Current portfolio

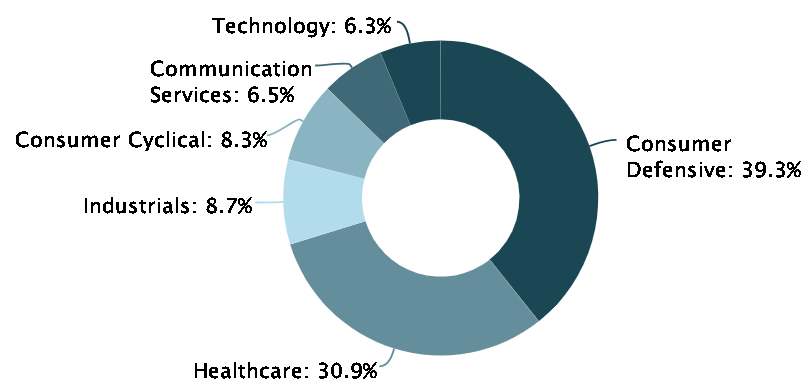

One thing I’ve realized after reading my letters from 2022 and 2023 is that I’ve had a tendency to focus on positions in the healthcare and consumer sectors, reducing my exposure to technology in my portfolio. In fact, this year I had 6 baggers (companies that multiplied by 2 or more), and if we look at the sectors, it becomes quite clear what I mentioned:

SFM 0.00%↑ : Supermarket chain. (Consumer)

HIMS 0.00%↑ : Telemedicine service. (Healthcare)

LWAY 0.00%↑ : Produces kefir, a dairy drink similar to yogurt. (Consumer)

LSF 0.00%↑ : Produces coffee creams, coconut waters, and other plant-based products. (Consumer)

ZVIA 0.00%↑ : Produces soft drinks, tea, and other beverages sweetened with stevia, a zero-calorie sugar substitute. (Consumer)

APP 0.00%↑ : Software that helps advertisers improve the monetization of their mobile apps. (Technology)

The funny thing about this last company is that I closed a 112% gain, but I didn’t really want to sell it. My Mexican broker has an option to sell by percentages and I wanted to sell 25%, but I ended up selling 100% by mistake. I thought, “Well, it’s gone up a lot, it will go down, and I’ll be able to buy more.” Spoiler: It didn’t go down. In fact, right now, I would have a 335% return if I hadn’t sold.

Currently, I have 17 positions in my portfolio, which I can categorize into three main groups, using an analogy to a football (soccer) team:

Team Stars: These have earned my highest conviction, either due to their performance or because I believe the thesis is strong enough. Therefore, they have more than an 8% weight in my portfolio, and I don’t usually trim the position much unless it goes over 12-15% of my portfolio.

Key Players: While they’re not the stars, they play a very important role in generating returns, and I have enough conviction to allocate between 5% and 8% of my portfolio to them.

Team Promises: These are investments that I’m still analyzing or that carry higher risk, so I assign them a weight between 1% and 4% of my portfolio.

Just like in a football team, the positions shift based on performance. If a "promise" is performing exceptionally well, it can move from the bench to become a key player (e.g., Laird Superfood LSF). On the other hand, if a player isn’t delivering the expected performance for their role, they may be benched or even leave the team (e.g., TransMedics TMDX and Sow Good SOWG).

So, by following this methodology, my current portfolio consists of the following positions:

Team Stars

Legacy Education (LGCY): They operate 5 campuses focusing on nursing, allied health programs, veterinary medicine, and health-related business services based in California. It’s a simple business to understand, but growing at double digits, profitable, debt-free, with good margins, and trading at a P/E of 13x. It’s hard not to assign a high weight to such an asymmetric investment.

Sprouts Farmers Market (SFM): A supermarket chain that specializes in organic, fresh, and healthy products. It’s the company that has been in my portfolio the longest and has earned its spot through a 275% return from my current average price.

Power Solutions International (PSIX): The company manufactures propulsion systems and engines. Behind the seemingly low sales growth is the Power Systems segment, which has been growing at +20% annually since 2018. This segment offers systems for backup power to prevent disruptions in data centers, hospitals, residences, and shopping centers. Trading at a P/E of 12x, the margin of safety seems wide, though I bought at $21 USD when it was trading at only 9x.

Mercado Libre (MELI): The largest e-commerce platform in Latin America, offering products from various categories as well as financial services through Mercado Pago, its online payment system. As a regular user of both platforms, I have a lot of confidence in the company, which is why I decided to give it a spot among the stars of my portfolio.

Key Players

Sensus Healthcare (SRTS): Sells equipment for the treatment of dermatological conditions like non-melanoma skin cancer or aesthetic treatments for scars, keloids, or fibrosis.

Its SRT machines are very beneficial for users because the traditional method would literally involve scraping the area with a sharp instrument to remove the skin cancer along with a surrounding margin of healthy tissue. Invasive methods that don't provide a good user experience and leave a large mark, unlike Sensus's products, which are based on low-energy X-rays.

Laird Superfood (LSF): This small company manufactures supplements such as coffee creams, prebiotics (high-fiber products), coffee, and others to improve hydration and athletic performance. These products are consistently among the bestsellers in their categories on Amazon, suggesting a high rate of adoption.

Hims & Hers (HIMS): A telemedicine platform that offers health products and services through an online subscription, covering areas such as mental health, hair care, sexual health, and general wellness. I’ve shared the link to the thesis I recently wrote.

Farmacias Guadalajara (FRAGUA.MX): A Mexican pharmacy chain with the concept of a "super pharmacy" that combines a pharmacy, convenience store, and supermarket all in one.

Crexendo (CXDO): A provider of telecommunications and cloud-based business communication solutions, offering services such as voice, video conferencing, and other collaboration tools for businesses.

Voxel (VOX.WA): A company that develops and commercializes software and hardware solutions for 3D visualization and simulation, particularly in fields such as healthcare and scientific research.

Talkspace (TALK): A digital platform that connects individuals with therapists and other mental health professionals via online communication, including chats, video calls, and text messages.

Team Promises

BranchOut Food (BOF): The company produces dehydrated fruit and vegetable snacks. It signed a letter of intent for $5M USD in sales for 2025 and an initial purchase order of $250,000 USD. Thanks to this order, the company expects to reach profitability in the first quarter of 2025 and would begin to experience operating leverage since the production plant is already built, and new orders would generate incremental profits.

Data Storage (DTST): A provider of data storage solutions and cloud services, specializing in technologies to manage and protect large volumes of data, which are highly valued by large data centers. I’m still researching the company, which is why the position is still relatively small.

BK Technologies (BKTI): A manufacturer of two-way radios and communication systems for critical sectors such as firefighters, ambulances, and security forces. Its margins are aggressively expanding thanks to new products and software they are developing, so I expect high EPS growth.

TransMedics (TMDX): I recently wrote a thesis about it, and I recommend taking a look. Its weight has decreased because it hasn’t performed well in recent months, but if it demonstrates that the thesis is still intact and the market rewards it, its weight in my portfolio will naturally increase.

Celsius (CELH): A company that produces energy drinks and has had a terrible year in 2024. I believe the slowdown in growth is due to the excessive stock that PepsiCo made by overestimating the brand's growth and because the sector has been somewhat negatively affected overall. I’ve seen the brand everywhere (supermarkets, gas stations, sports events, etc.), so I think they could turn the situation around at some point. The situation is complicated in the short term, which is why I’m not assigning a large percentage of my portfolio to it.

Exagen (XGN): The company develops diagnostic tests for autoimmune diseases, such as lupus and rheumatoid arthritis, using blood biomarkers. I consider it speculative because it’s not yet profitable, but I think it’s worth following because of its product, aligned management team, high margins, low debt, and a valuation of only 1.5x EV/Sales.

2024 performance

This year ends with my third consecutive year of outperforming the S&P 500 by a wide margin. In 2021, only the months of November and December count because the broker I was using at that time no longer exists, and I have no way of retrieving the trades from that period (such a shame).

In this way, my annualized return is 20.4% since November 2021. Considering that my goal is to achieve at least 15% annualized returns over long periods, I feel quite proud of this result, especially considering that 2022 was in the middle of it and that 2021 was so bad.

2025 expectation

Historically, after two consecutive years where the S&P500 returns more than 20%, the third year is usually good as well. Although this is not something that happens frequently in history, it seems that the few times it does happen, it usually has this result.

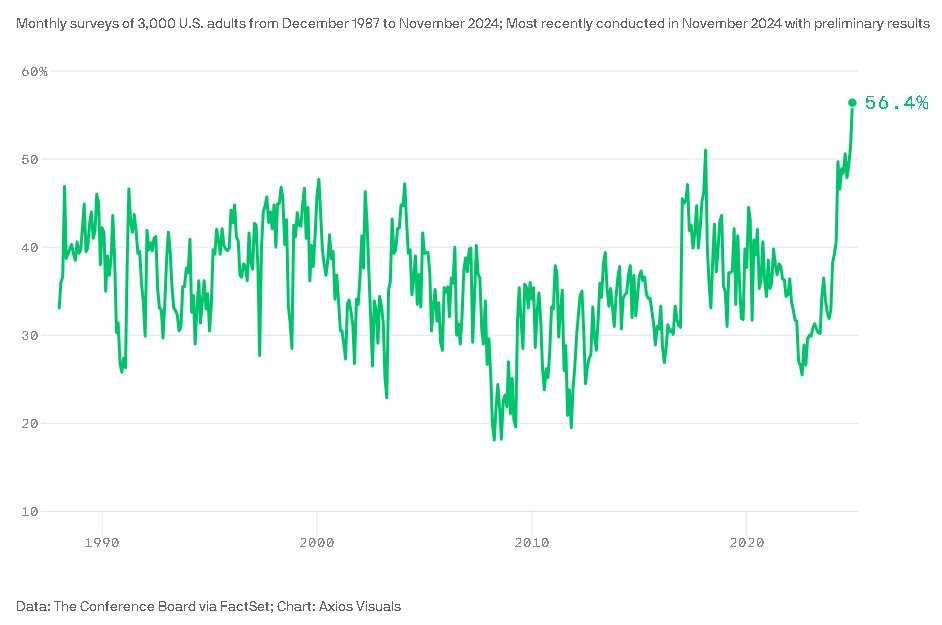

Personally, I feel a bit more conservative. The following survey shows that, as of November 2024, 56% of American adults surveyed expected the market to end higher in 2025 than the previous year. This optimism is at an all-time high, and general public sentiment is often a contrarian indicator. The more greed and optimism there is, the better it is to be cautious (as in 2021).

Of course, I don't base my entire analysis solely on this survey. There are other indicators, such as the net long positioning in S&P500 futures by institutional investors, which is now double what it was during the 2020-2021 bull market. There’s also the excessive euphoria in the crypto market and the return of "meme-coins." Even friends and family who have never talked to me about the stock market are now asking me what they should invest in. I don't know, in general I’m perceiving a pattern that I haven't seen since the previous market peak (2021).

My solution is to stay invested, but prepare a lot of cash in case a bear market begins. In addition, I plan to quickly cut many positions if we see a massive loss of moving averages in stocks and indices, especially. We will see what 2025 has in store for us, but, initially, I’m optimistic, but taking many precautions. Anyway, happy New Year to everyone and I hope that this 2025 will be one of historical highs in the portfolios of each one of you!

Disclaimer

All content on this blog is for informational purposes only and under no circumstances, whether express or implied, shall be considered investment, legal or other advice. Please do your own research and due diligence.